PJM Price Formation: Upcoming Changes to Fast-Start Pricing

.jpg?sfvrsn=e4853341_0)

In an earlier blog highlighting PJM’s price formation proposal, we discussed one aspect of price formation, which was related to transforming the way reserves are priced into the market.

Here, we’ll cover the latest developments on another aspect of price formation, known as fast-start pricing.

FERC’s ruling

The Federal Energy Regulatory Commission (FERC) ruled on April 18, 2019 that PJM must change the formula that sets the hourly price of power to include units that can respond quickly and start in under an hour. The new formula will result in generation resources setting a higher price for the energy that customers will pay for generation service.

PJM has targeted an implementation date of January 2020 to put the new pricing rules in place before winter.

Fast-start resources defined

Fast-start resources are generators capable of starting up within 1 hour or less with a minimum run time of one hour or less. These resources are typically called upon when other resources have unexpectedly come offline or in periods of peak demand, when system conditions are tight, as they can start up quickly to meet load.

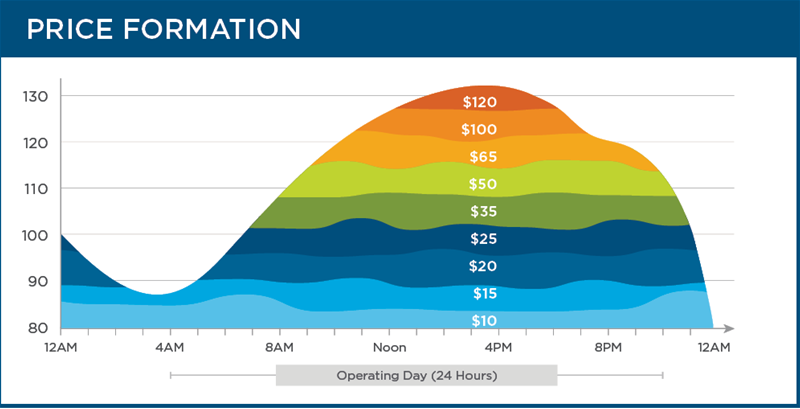

As we discussed in the previous blog, resources bid into the market, stacking up the lowest price until demand is met at that given point in time. The last resource capable of filling demand and the next increment of load sets the price.

Fast-start resources face a couple of challenges in this current formula. They tend to either be block-loaded, which means the minimum and maximum output are the same, or they have very small ranges between their operating minimum and maximum. This means they have little to no opportunity to set the price, as they often cannot serve the next incremental load.

As a simplified example, in the graph above, the market is approaching peak demand (350 MW). In order to economically dispatch units to meet demand, PJM would have to dispatch Resource A & Resource B, the fast-start resource. Although the grid is using Resource B, Resource A sets price because its offer was a lower price and it can fill the next increment of load. Resource B can never set the price because its minimum output equals its maximum output, meaning it cannot fill the next increment of load. Under current rules, the price for power would be $50/mWh, but after the change, the fast start unit would set the price that everyone pays for generation at $70/mWh.

The issues with this approach

As a result, many fast-start resources operate for very few hours during which energy rates are high enough to cover their costs. This presents several challenges to the current market design as these fast-start resources receive out-of-market payments for the difference between their offer and the price of energy. On top of that, the price for energy does not reflect the price to serve demand. This leads to decreased opportunity for competition between generators, challenges for suppliers to accurately mitigate risk, and even some operational expenses being passed down through the market, often all the way to the customer.

The Commission is requiring PJM to make the following tariff revisions:

• Implement software changes so that fast-start resources are considered dispatchable from zero to their economic maximum operating limits for the purpose of setting prices

• Apply fast-start pricing to all fast-start resources

• Alter the real-time energy market clearing process to consider fast-start resources in a way that is consistent with minimizing production costs

• Restrict eligibility for fast-start pricing to fast-start resources that have a start-up time (including notification time) of one hour or less and a minimum run time of one hour or less

• Include commitment costs in energy prices for fast-start resources in both the day-ahead and real-time markets

• Implement its proposal to use lost opportunity cost payments to offset the incentive for over-generation or price chasing

The potential impacts of market changes

While it is difficult to simulate the impact of market changes to bidding behavior, PJM ran a simulation of 2018 prices given the rule changes. On average, hourly LMP (locational marginal pricing, which we covered in the previous blog) would have been $1.31/MWh higher. This equates to an increase of 4% to the cost of generation supply.

According to Joe Haugen, director of power supply with IGS, “It is likely that these costs will be higher in the future. As more renewable generation is built, fast-start resources may be needed more frequently due to the intermittent nature of renewable resources.”

How to protect your power costs

The January 2020 implementation is quickly approaching. It’s now time to better understand how these changes could impact your business. Locking in a long-term contract is a potential option to avoid risk, but our experts are here to help guide you through the process. Consider protecting your business now to better control your electricity costs.

We're here to help